Future Homes Brighter Futures

The McClain Group works within one of the Denver's highest grossing real estate firms, Madison & Company Properties. As an experienced and unified real estate team they embody the passion, execution and dedication necessary for the discovery and sale of high-end residential homes.

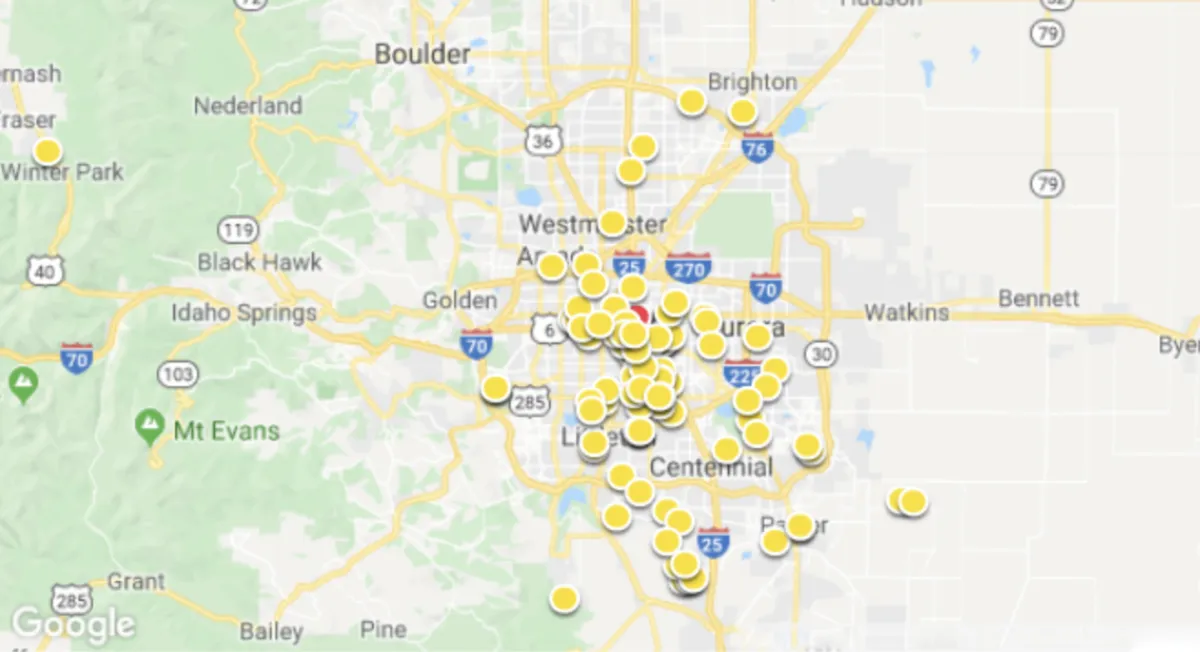

See What Your Home Is Worth Below

Meet The McClain Group

The McClain Group has won numerous awards, based on customer service and satisfaction. Year after year they are also a top overall residential producer at Madison & Company Properties. The McClain Group focuses primarily on the Denver metro area and their business is built off of the relationships that they have established and the network that they have built over the last fifteen years in real estate. With Madison & Company Properties resources and reputation, and the McClain Group’s expertise, this dynamic team is exceptionally prepared to drive the highest yield possible for you and your family.

What Clients Are Saying

Why Work With The McClain Group

Experience & Qualifications

Over 23 years combined experience of being licensed residential Realtors and we have been recognized year after year for customer service and satisfaction.

Giving Back

We believe in Giving Back and we are proud to host a Biennial Birdies for Butterflies Golf Tournament which benefits children with EpidermolysisBullosa(EB) and to donate after every closing a Kindle to Bags of Fun.

Deluxe Service

We believe that everyone deserves an amazing experience when buying or selling their home and we pride ourselves on providing deluxe service to all of our clients.

Connect With Us

Larina McClain | REALTOR®

Phone: 720-275-9663

Email: Larina@McClainGroupRe.com

Bree Vialpando | REALTOR®

Phone: 720-301-3290

Email: Bree@McClainGroupRe.com

Dani Kravitz | OPERATIONS OFFICER

Phone: 631-576-7454

Dani@McClainGroupRE.com

Cherry Creek North

© Madison and Company Properties, LLC. Madison and Company Properties is a registered trademark licensed to Madison and Company Properties, LLC. Locally owned and operated. An equal opportunity company. Madison & Company is committed to compliance with all federal, state, and local fair housing laws. All information deemed reliable but not guaranteed. If you have a brokerage relationship with another agency, this is not intended as a solicitation. www.madisonprops.com | www.madisonpropsblog.com

Copyright 2023. All Rights Reserved. Privacy Policy